How Can I Diversify My Crypto Portfolio to Minimize Risk?

Imagine this: You hear about a new cryptocurrency that seems promising. You decide to invest all your savings, hoping to get rich. But then the market crashes, and the value of your investment drops significantly. Ouch! This is the tough lesson learned when you don’t diversify your crypto assets.

The Risks of Investing in One Cryptocurrency

Putting all your money into one cryptocurrency is like betting everything on a single horse in a race. It might win, and you could make a lot of money. But if it loses, you risk losing everything. The crypto market is known for its wild price changes. If all your money is in one cryptocurrency, you’ll feel the full impact of those changes.

Diversification: Your Safety Net

So, what can you do? The answer is diversification. Think of it like having several eggs in a basket instead of just one. If one egg breaks, you still have others. By spreading your investments across different cryptocurrencies, you can lessen the effect if one doesn’t do well. If one crypto’s value drops, others might go up, balancing your overall investment.

Why Diversification is Important

- Sleep Better at Night: Diversification helps you avoid panic when the market dips.

- More Opportunities for Big Wins: A mix of cryptocurrencies gives you a better chance of finding a winning investment.

- Lower Risk of Major Losses: Even if one cryptocurrency performs poorly, your portfolio won’t take a huge hit.

Busha Makes Diversification Simple

At Busha, we understand the importance of diversification. That’s why we offer a wide range of cryptocurrencies, making it easy for you to build a balanced portfolio. Whether you're experienced or just starting out, Busha has the tools and support you need to diversify and succeed in the exciting crypto world.

Download The Busha App Today

What is Diversification, and Why Does it Matter?

Let’s simplify it. Diversification means spreading your investments across different assets to lower risk. In the crypto world, this means investing in several cryptocurrencies instead of just one.

Why Diversification is Key in Crypto

The crypto market is like a rollercoaster—exciting but full of ups and downs. One day, a cryptocurrency might soar in value, and the next day, it could drop sharply. This unpredictability makes diversification even more important. It is a safety net, helping you manage the market’s wild swings.

Benefits of a Diversified Crypto Portfolio:

- Less Risk of Big Losses: If one cryptocurrency drops in value, others can help balance your losses.

- Increased Potential for Gains: By investing in various cryptocurrencies, you enhance your chances of gaining from their growth.

- Peace of Mind: Knowing your investments are spread out helps you relax, even when the market is shaky.

Read More:

- 11 Best Indicators for Crypto Trading in 2024: A Beginner-Friendly Guide

- What Are the Best Practices for Managing My Crypto Assets?

Ready to Create a Strong Crypto Portfolio?

Let’s explore the practical steps to diversify like a pro!

Steps to Diversify Your Crypto Portfolio

Now that you see how important diversification is let’s get started. Here’s a simple step-by-step guide to help you diversify your crypto portfolio:

Step 1: Review What You Own

First, take a look at what cryptocurrencies you currently have. What coins do you own, and how much did you invest in each? Be honest about the risks and rewards of your current investments. This will help you spot areas where you might have too much invested and where you can diversify.

Step 2: Set Your Goals

Before diversifying, consider what you want to achieve with your investments. Are you looking for long-term growth, short-term profits, or both? How much risk are you comfortable taking? Your goals will help you decide how to diversify and which cryptocurrencies to choose.

Step 3: Do Your Research

Research is vital for crypto investing. Don’t just follow the latest trends. Take the time to learn about different cryptocurrencies, their technology, uses, and the teams behind them. Look for projects with strong foundations and a clear plan for the future.

Step 4: Spread Your Investments

Asset allocation means dividing your investments among different types of assets to match your desired level of risk and return. In crypto, this means deciding what percentage of your portfolio to put into various cryptocurrencies. A common strategy is to put more money into well-established, large-cap cryptos and less into mid-cap and small-cap ones.

Step 5: Keep Everything Balanced

The crypto market is always changing, so checking your portfolio regularly is important. This means adjusting your investments to make sure they still match your goals and risk level. Balancing your portfolio helps you stay on track and prevents you from having too much invested in one cryptocurrency.

You Might Also Like:

- Top 10 Applications of Blockchain Technology Beyond Finance

- What Are the Latest Cryptocurrency Tax Regulations for 2024? (Nigeria Focus)

Key Strategies for Diversification

Now that you know the basic steps, let’s look at some effective strategies to diversify your crypto portfolio:

- Diversify by Market Cap: Think of market cap as the size of a company. Large-cap cryptos are like big, established companies, while small-cap cryptos are like startups. Mixing large, mid, and small-cap cryptos can help balance your portfolio.

- Diversify by Sector: The crypto world is large and varied, with different areas like DeFi (decentralized finance), NFTs (non-fungible tokens), and Web3 (the next internet). Investing in projects from different sectors helps diversify your portfolio.

- Diversify by Geography: Don’t just invest in projects from one region. Look for cryptocurrencies from around the world to add variety to your portfolio.

- Dollar-cost averaging: This strategy involves investing a set amount of money regularly, no matter the market price. It helps you avoid trying to time the market and can be useful in the unpredictable crypto market.

Using these strategies, you can create a diversified crypto portfolio that can handle market ups and downs and is set for long-term growth. Diversification isn’t a one-time task; you must keep managing and adjusting.

Related post: How To Grow Your Finances with Dollar Cost Averaging (DCA)

Common Mistakes to Avoid

Even with good intentions, it’s easy to make mistakes when diversifying your crypto portfolio. Here are some common pitfalls to avoid:

1. Putting All Your Eggs In One Basket

Don't put all your money into one cryptocurrency. No matter how promising it looks, investing too much in a single coin can lead to big losses. Diversification helps protect you.

2. FOMO Frenzy

The fear of missing out (FOMO) can cause you to make quick, impulsive decisions. Don’t just follow the crowd; do your research. A popular crypto today could lose value tomorrow.

3. Security Slip-ups

Your crypto is only as safe as your security measures. Use strong passwords, enable two-factor authentication, and watch out for phishing scams. Poor security can wipe out your investments, no matter how diversified you are.

4. Panic Selling During Drops

The crypto market can be unpredictable. When prices fall, it’s normal to feel nervous. But panic selling usually isn't wise. Stay calm, stick to your plan, and remember that market dips often don’t last long.

How To Easily Diversify with Busha

Want to create a strong and diverse crypto portfolio? Busha can help you with that! Here’s how we make it simple:

1. A Wide Range of Crypto Options

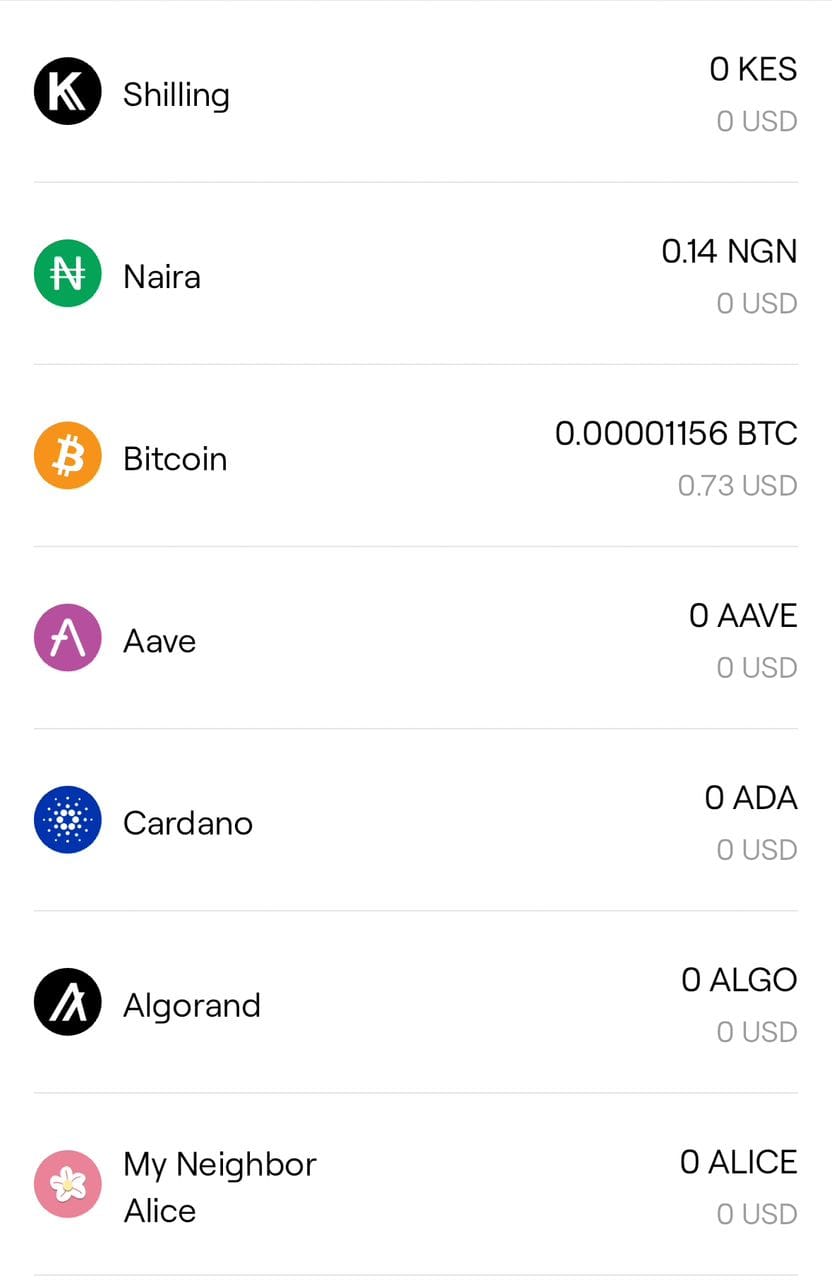

We offer many cryptocurrencies, from well-known ones like Bitcoin and Ethereum to new and exciting projects. With Busha, you can easily explore and diversify across different sizes, sectors, and regions.

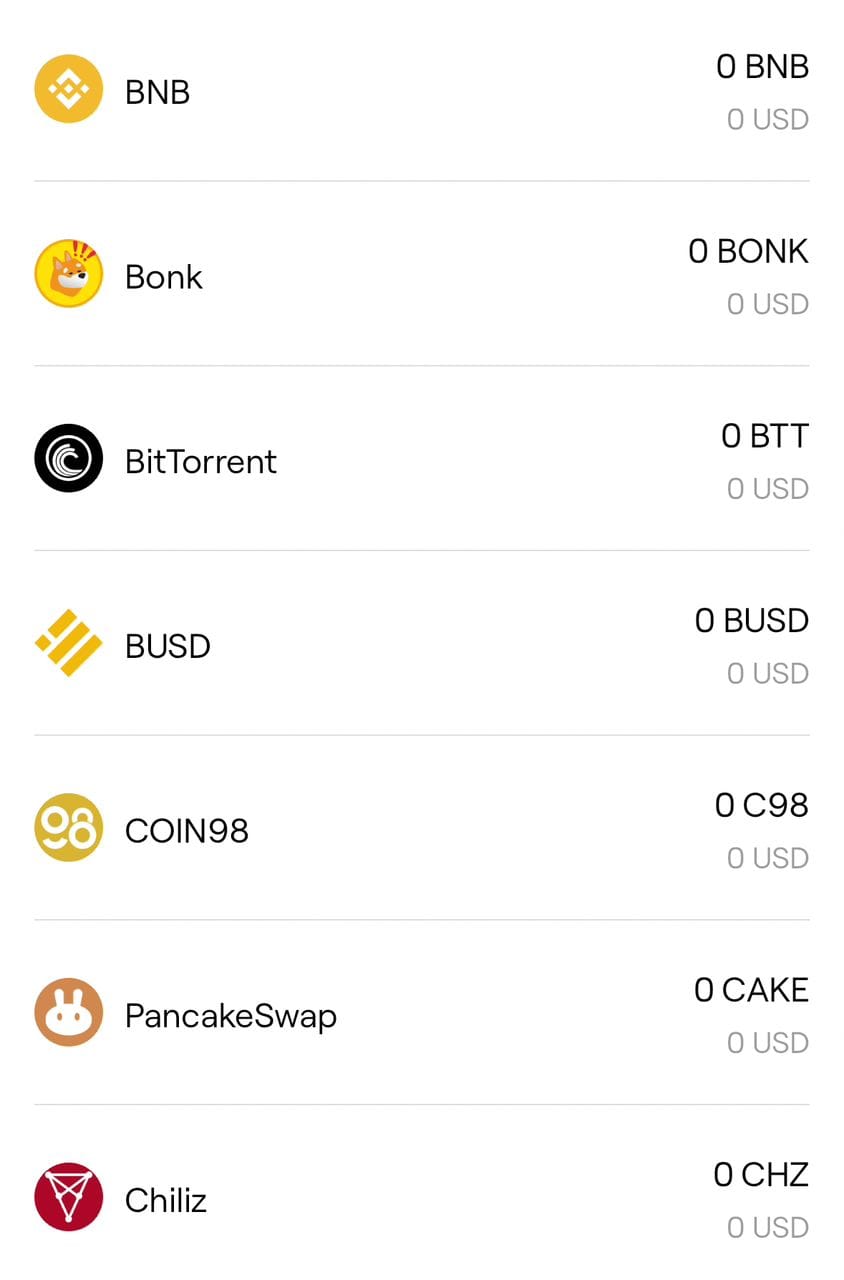

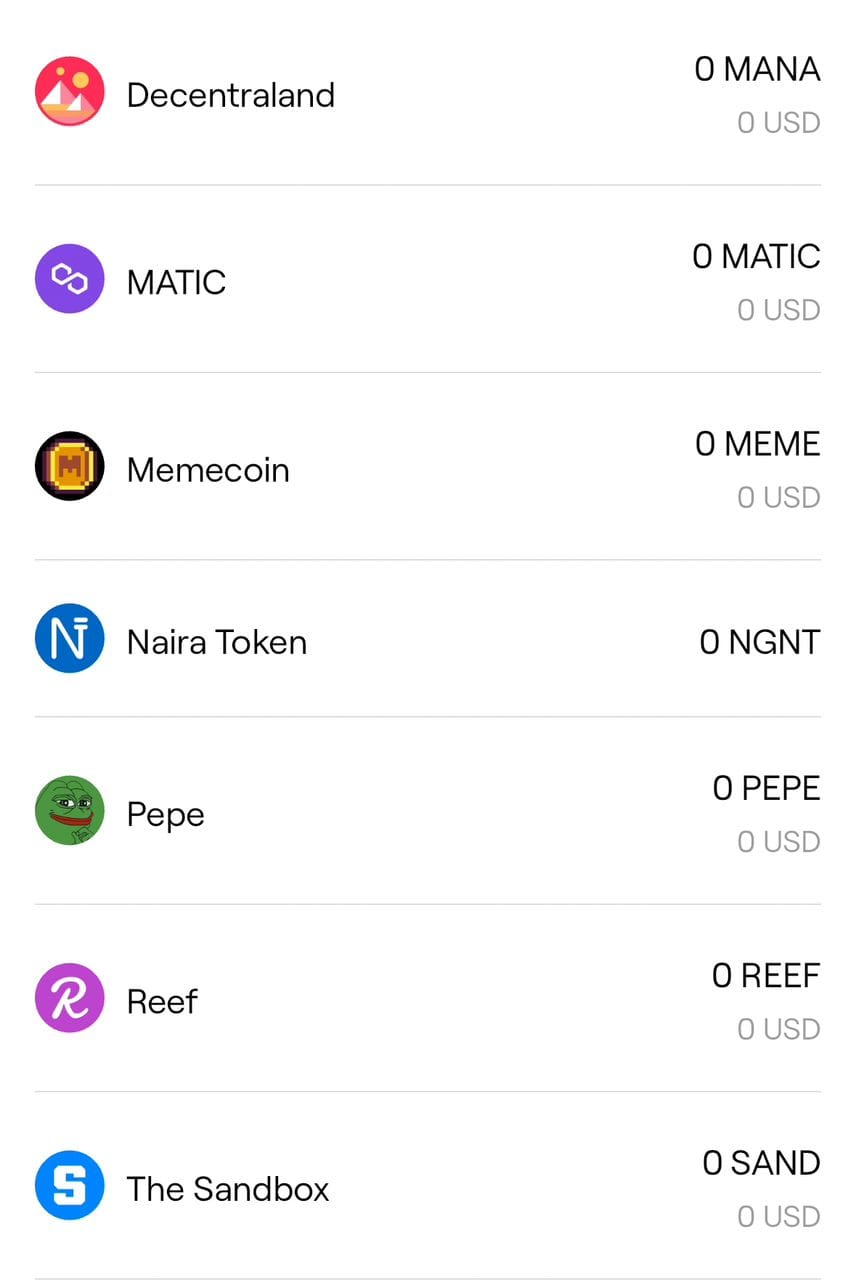

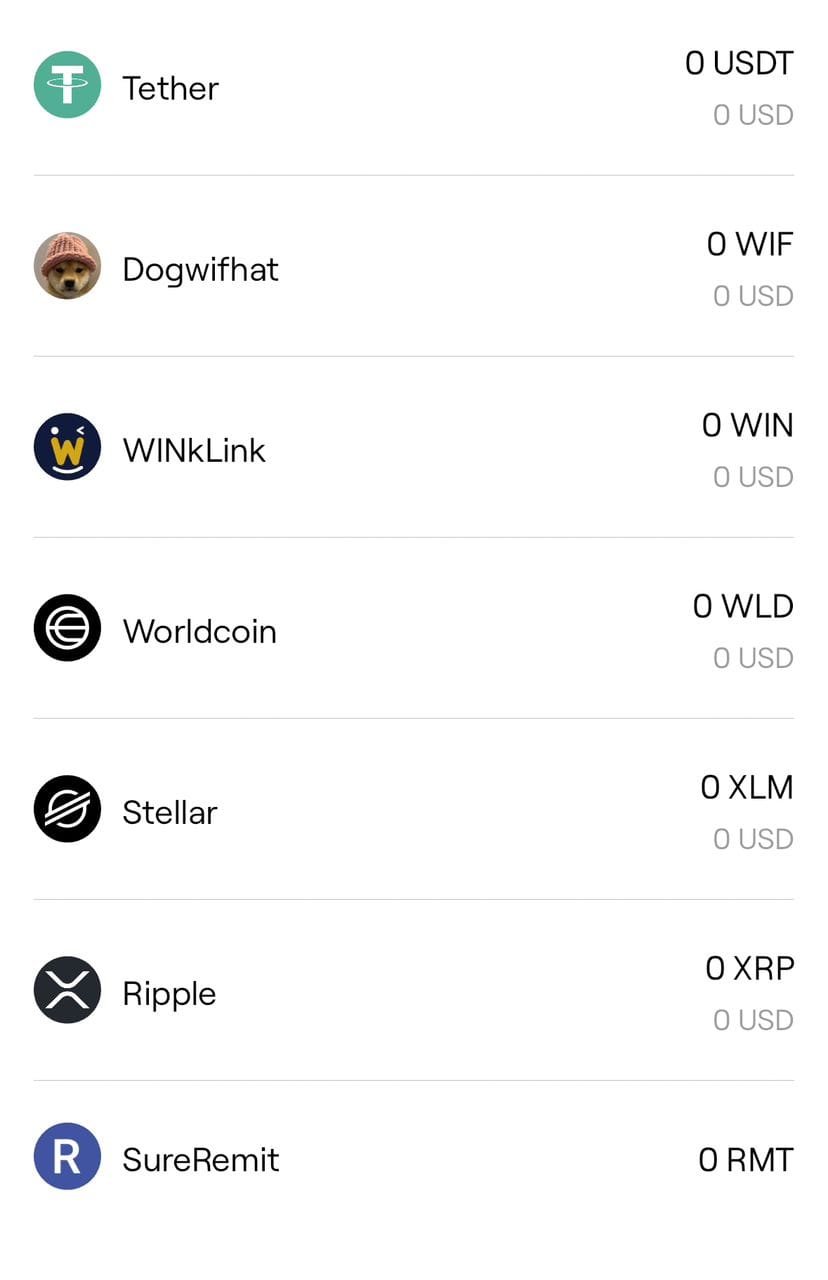

Here are some of the diverse cryptocurrency options available on the Busha platform

2. User-Friendly Experience

Our easy-to-use platform makes buying, selling, and managing crypto simple, even for beginners. We provide the tools and information you need to make smart decisions and build a portfolio that matches your goals.

3. Top-Notch Security

As an SEC-licensed platform, we value your peace of mind. We use the best security measures to protect your crypto assets so you can confidently focus on growing your portfolio.

Ready to start? Create your Busha account today and begin diversifying your crypto portfolio like a pro!

Frequently Asked Questions on How To Diversify Crypto Portfolio

1. How should you diversify your crypto portfolio?

Think of it like creating a balanced meal. Just like you need a variety of food groups to stay healthy, you should invest in different types of cryptocurrencies. Mix big ones, small ones, and those focused on different areas like finance or digital art. If one type isn’t doing well, others can help balance things out.

2. How should I split my crypto portfolio?

There’s no single answer; it depends on your risk level and goals. A common method is to invest 60-70% in established cryptocurrencies like Bitcoin and Ethereum, and use the rest for mid-cap and small-cap coins that have higher growth potential but also more risk.

3. What is a good crypto portfolio allocation?

A good allocation matches your personal situation and risk comfort. Conservative investors might put more money into large-cap cryptos, while risk-takers might choose more smaller, high-risk projects. Always research and understand the risks before investing.

4. How many cryptocurrencies should be in my portfolio?

There’s no magic number, but experts often suggest starting with 5-10 different cryptocurrencies for good diversification. Focus on quality over quantity—choose projects that have strong foundations and clear purposes.

Remember, diversification is an ongoing process. Check your portfolio regularly, rebalance as needed, and stay updated on the changing crypto world. If you want a platform that makes diversification easy, Busha is here to support you every step of the way!

Read More: