How the Naira Depreciated Against the Dollar in 20 Years

In this blog post, we will embark on a two-decade journey from 2003 to 2023, exploring how the Nigerian Naira has continuously depreciated against the US Dollar, uncovering the complex factors behind this phenomenon. So, let's start by understanding the concept of currency depreciation.

What is Currency Depreciation?

Currency depreciation is when a country's money becomes less valuable than other currencies, affecting its economy and international trade. This devaluation has substantial consequences, especially for Nigeria, where the Naira is the lifeblood of its largest economy.

How the Nigerian Naira Depreciated Against the US Dollar: Historical Pattern

Over these two decades, the Naira has consistently lost value against the US Dollar. To illustrate this, here's a historical look at the exchange rates and percentage changes over the years, highlighting the Naira's diminishing purchasing power.

Please note that these figures were obtained from trading economics. They represent the official exchange rates and may not reflect those in the parallel or black market, which can vary significantly. The percentage changes indicate the relative depreciation or appreciation of the Naira against the US Dollar in each respective year. This table provides a clear visualization of the annual exchange rates and the percentage changes for the Nigerian Naira against the US Dollar over the specified years.

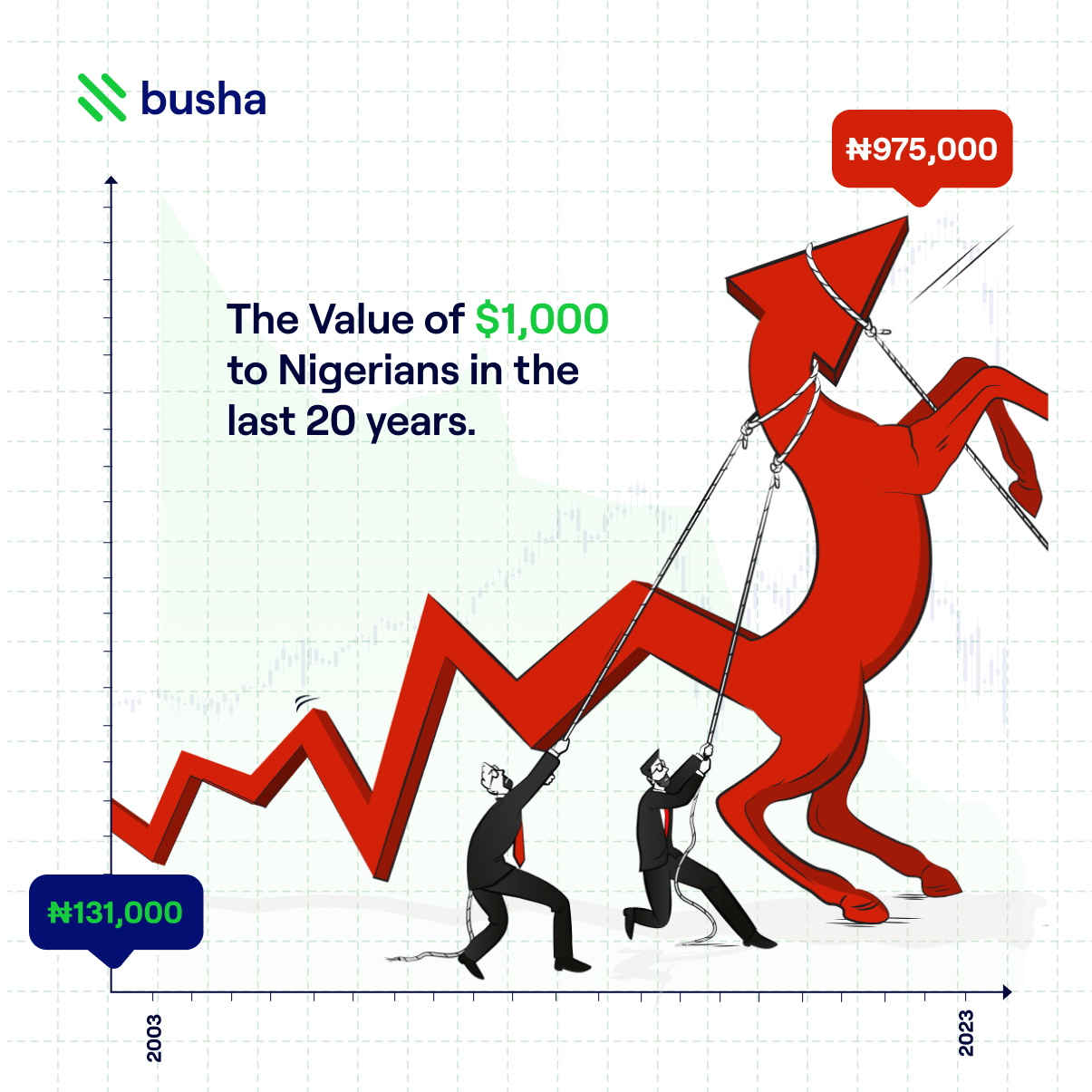

Here is a visual representation of the value of $1000 to Nigerians from 2003 to 2023, showing the black market rate.

Why has the Naira been Depreciating Against the US Dollar for 20 years?

The two-decade-long Naira depreciation against the US Dollar stems from a complex interplay of factors. Understanding these underlying causes provides valuable insights into ongoing Naira devaluation. Here, we explore five key influencers:

- Heavy Oil Reliance: Nigeria's overreliance on oil exports, while a revenue source, leaves the Naira vulnerable to global oil price fluctuations, contributing to its volatility.

- Weak Diversification: Struggles to diversify the economy beyond oil have exposed Nigeria to oil price shocks, further fueling Naira depreciation.

- Exchange Rate Policies: Frequent changes in exchange rate policies, from fixed to floating rates, have bred uncertainty in the foreign exchange market, reducing investor confidence and pressuring the Naira.

- Foreign Reserve Depletion: Depleted foreign exchange reserves, especially during low oil prices, limit the Central Bank's ability to defend the Naira.

- Rising Inflation: Persistent inflation erodes Naira's purchasing power, making it less attractive to hold and contributing significantly to depreciation.

How Does Depreciation Affect Nigerians?

The depreciation of the Naira has significant implications for the people of Nigeria:

- Purchasing Power Erosion: Depreciation leads to higher prices for imported goods, which, in turn, erodes the purchasing power of consumers. Everyday essentials, including food, fuel, and electronics, become more expensive, affecting ordinary citizens' living costs.

- More Expensive Living: The Naira losing value can increase prices for many things we need, making it tough for families to keep up with their expenses.

- Business Uncertainty: For businesses, exchange rate instability can create uncertainty. Firms that rely on imported raw materials or equipment may face increased costs, potentially leading to reduced profitability or layoffs.

- Investment Concerns: Currency depreciation can deter foreign investment. Investors may be reluctant to commit capital in an environment of exchange rate volatility and uncertainty, limiting economic growth and job creation.

- Reduced Savings: Citizens holding Naira-denominated savings may see the real value of their savings diminish as inflation rises alongside currency depreciation.

- Social Impact: Currency devaluation can exacerbate income inequality, as the impact is often felt more acutely by lower-income households who spend a larger portion of their income on essentials.

How To Safeguard Your Wealth Amid Naira's Depreciation

Securing your wealth is now more important than ever before, as the past two decades have shown that the Naira’s volatility has resulted in significant consequences for the financial stability of Nigerians. So then, what can Nigerians do? Hold USD!

We know this seems like one of the “easier said than done” scenarios. However, with innovative solutions like Busha Yield, it is within arms reach. This game-changing crypto savings solution has helped several Nigerians protect their money against the effects of the Naira depreciation since its launch almost 2 years ago. You are able to save your money in dollar stablecoins - USDT, watch it appreciate and earn up to 7.5% per annum.

Here’s a clearer picture: if you saved N1,000,000 in January of 2022, right now, it’ll be worth almost double that in USDT, as shown by the table above. Let’s help you discover how Busha Yield can provide a reliable way to safeguard your wealth.

The Power of Busha Yield

Busha Yield isn't just a crypto savings tool; it's a financial shield against currency devaluation and inflation, offering growth potential. Here's how you can use Busha Yield to protect your money in the face of Naira depreciation:

- Insulate from Currency Devaluation: By saving in Dollar-pegged stablecoins with Busha Yield, your wealth remains resilient against Naira devaluation.

- Combat Inflation: Busha Yield's interest rates can outperform traditional institutions, allowing your savings to retain or grow in value, even amidst inflation.

- Flexibility and Accessibility: Your funds are easily accessible, with no withdrawal deductions or fees. Daily interest payments keep you informed about your growing returns.

- User-Friendly Experience: Busha Yield's user-friendly platform suits both crypto newcomers and experienced investors.

- Diversification: While stablecoins provide stability, Busha Yield offers opportunities to explore other crypto assets for potential growth.

Don't let Naira depreciation further erode your wealth. Join the community using Busha Yield to protect and grow their assets in this evolving financial landscape. Your financial security is within reach – seize it with Busha Yield.

Read Next: