The 10 Biggest Bitcoin Myths You Should Know About

Bitcoin has become increasingly popular worldwide and is changing how we think about money. However, along with its rise, there are many misunderstandings and false beliefs about it. These misconceptions can make it harder for people to understand and accept Bitcoin. In this blog post, we will explore the ten biggest Bitcoin myths that you should know about. By debunking these myths, our goal is to give you a better understanding of Bitcoin and help you make informed choices in the cryptocurrency world. So, let's separate truth from fiction and uncover the reality behind these common Bitcoin myths.

Bitcoin: Debunking the 10 Biggest Bitcoin Myths

Here are the 10 biggest Bitcoin Myths of 2023:

- Bitcoin is Anonymous

- Bitcoin is Used Only for Illegal Activities

- Bitcoin is a Ponzi Scheme

- Bitcoin is Too Volatile to be a Stable Investment

- Bitcoin is Only for Tech Experts

- Bitcoin is a Bubble that Will Burst Soon

- Bitcoin Can Be Hacked

- Bitcoin Has No Real Value

- Bitcoin Is Just a Digital Currency

- Bitcoin Will Replace Traditional Currencies

1. Bitcoin is Anonymous

Bitcoin is often misunderstood as an anonymous digital currency, but it operates on a transparent and public ledger called the blockchain. While Bitcoin transactions don't reveal personal information, the transaction details are recorded on the blockchain, accessible to anyone. Each transaction includes a sender, receiver, and the amount of Bitcoin transferred.

While real identities aren't directly linked to Bitcoin addresses, blockchain analysis can identify patterns and connect addresses to individuals. Sophisticated techniques used by analysis companies and researchers allow them to track transaction flow and make educated guesses about address owners. Additionally, transactions involving regulated exchanges may require identification due to anti-money laundering (AML) and know-your-customer (KYC) regulations.

2. Bitcoin is Used Only for Illegal Activities

Bitcoin's connection to illegal activities is a common misconception that overlooks its legitimate applications. While it's true that Bitcoin has been used for illicit transactions due to its pseudonymous nature, it's crucial to acknowledge that the majority of Bitcoin transactions are lawful and serve valid purposes. One significant legitimate use of Bitcoin is for online shopping, with many merchants and platforms accepting it as payment. From e-commerce websites to digital services, Bitcoin provides a decentralized and borderless method of global transactions.

Busha has also introduced Busha Spend, a feature enabling users to spend their cryptocurrency directly from their Busha wallet. With Busha Spend, users can purchase airtime and data subscriptions for Nigerian mobile numbers, making everyday transactions more convenient and offering instant cashback rewards. In conclusion, despite its association with illegal activities, Bitcoin has widespread legitimate uses, providing secure and efficient transactions for individuals and businesses in the digital age.

- Take a moment to read this step-by-step guide on how to Trade Bitcoin in Nigeria

3. Bitcoin is a Ponzi Scheme

The claim that Bitcoin is a Ponzi scheme is baseless and misleading. Bitcoin is not a Ponzi scheme but a decentralized digital currency. Unlike a Ponzi scheme, Bitcoin does not rely on a central authority or promise unrealistic returns. Its value derives from market demand, scarcity, and utility. Transactions are transparently recorded on a blockchain accessible to all participants, making Bitcoin resistant to manipulation. It has gained widespread adoption, recognition, and regulatory frameworks, setting it apart from fraudulent schemes. While Bitcoin carries risks and volatility, labelling it as a Ponzi scheme is incorrect.

4. Bitcoin is Too Volatile to be a Stable Investment

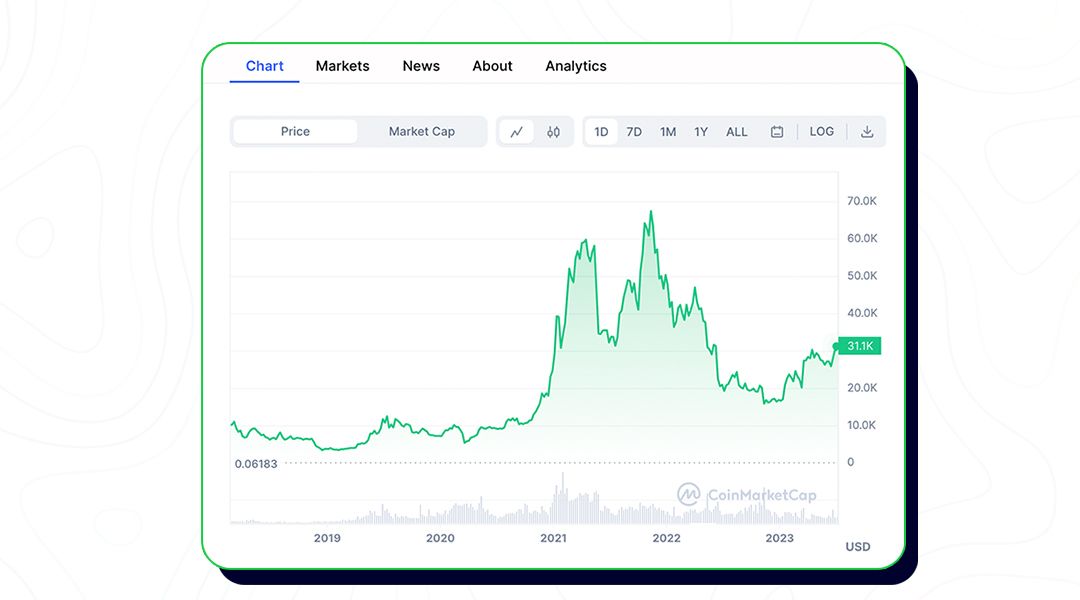

Bitcoin has shown remarkable growth and resilience over the years, attracting many investors who view it as a long-term investment opportunity. Despite periodic price fluctuations, the overall trend has been a substantial appreciation. Bitcoin's value has increased significantly since its inception, creating significant returns for early adopters and long-term holders.

The volatile nature of Bitcoin can be attributed to various factors, including market demand, macroeconomic conditions, regulatory developments, and investor sentiment. The limited supply of Bitcoin, with a maximum cap of 21 million coins, coupled with increasing mainstream adoption, has contributed to its upward price trajectory.

Moreover, the inherent characteristics of Bitcoin, such as decentralisation, transparency, and immutability, have captured the interest of institutional investors, corporations, and even governments. Major financial institutions have begun to recognise Bitcoin as a legitimate asset class, offering their clients various investment products and services. This growing institutional participation brings stability and credibility to the cryptocurrency market.

- Take a moment to read this blog post that will guide you on how to start your Bitcoin investment journey with the right amount.

5. Bitcoin is Only for Tech Experts

The reality is that anyone can learn to use Bitcoin, even without technical expertise. User-friendly wallets and exchanges have made it easier for the general public to access and navigate the world of Bitcoin. These platforms provide intuitive interfaces, QR code scanning, transaction history, and guides to simplify the experience.

Reputable cryptocurrency exchanges offer clear instructions, customer support, and educational resources. Online communities, forums, and educational materials are also available for beginners to learn at their own pace. While technical knowledge can be helpful, it is not a requirement to engage with Bitcoin. With the right tools and a willingness to learn, anyone can participate in the digital currency revolution.

6. Bitcoin is a Bubble that Will Burst Soon

Despite the ongoing debate about Bitcoin being a bubble that will burst, it has consistently proven its resilience and legitimacy as a digital asset. Bitcoin's widespread acceptance and adoption by governments and regulatory bodies have dispelled concerns about its bubble status. The increasing infrastructure supporting Bitcoin, such as reliable exchanges, secure wallets, and improved liquidity, has also contributed to its longevity. These factors have made Bitcoin more accessible and solidified its position as a viable and enduring investment option.

7. Bitcoin Can Be Hacked

While individual wallets and exchanges may be vulnerable to hacking attempts, it is essential to distinguish between the Bitcoin network's security and its components' security. The Bitcoin network has never been hacked since its inception, thanks to its underlying blockchain technology. The blockchain is a decentralized ledger that records and verifies transactions, making it highly resistant to hacking.

However, users should still take precautions to protect their wallets and accounts by using reputable wallets with solid security features, following best practices for safeguarding personal information and private keys, and opting for encryption, two-factor authentication, and offline storage options. By adopting these measures, users can significantly enhance their security and minimize the risk of unauthorized access to their funds.

- Take some time to read this blog post that offers insights and guidance on the process of recovering funds from cryptocurrency scams.

8. Bitcoin Has No Real Value

Bitcoin derives its value from several key factors. Its scarcity sets it apart from traditional fiat currencies that can be endlessly printed. Its perceived value is enhanced with a limited supply capped at 21 million Bitcoins. Secondly, Bitcoin serves as a medium of exchange, enabling secure and fast transactions globally. Its decentralized nature eliminates the need for intermediaries, promoting financial inclusivity and reducing costs, particularly in regions with limited banking infrastructure.

Furthermore, businesses' increasing acceptance of Bitcoin adds to its value, with numerous companies now recognizing it as a valid payment option. This growing ecosystem highlights Bitcoin's practical utility. While Bitcoin's value is subjective and influenced by market dynamics, its upward trajectory suggests widespread recognition and perceived value among a significant global population.

9. Bitcoin Is Just a Digital Currency

Bitcoin's significance extends beyond its perception as a digital currency. Its underlying technology, blockchain, has transformative potential across various industries. By facilitating secure and transparent transactions, blockchain can revolutionise finance, supply chain management, healthcare, real estate, and more. In finance, blockchain streamlines processes, reduces costs and enhances security. Supply chain management benefits from traceable systems, ensuring authenticity and ethical practices. Healthcare improves through enhanced data interoperability and privacy. Real estate transactions have become more secure and efficient. These examples highlight how blockchain, the foundation of Bitcoin, can disrupt and revolutionise industries beyond digital currency.

10. Bitcoin Will Replace Traditional Currencies

Bitcoin is unlikely to replace traditional currencies entirely and is more likely to coexist alongside them. Traditional currencies have a long-established history, widespread acceptance, and stability backed by governments and central banks. The infrastructure supporting traditional currencies is well-established, providing convenience and consumer protection. While Bitcoin offers unique advantages, such as decentralisation and borderless transactions, its volatility and lack of integration with existing systems limit its potential for a complete replacement. Instead, Bitcoin is expected to serve as an alternative financial system, particularly in regions with limited banking infrastructure. The future may also see the integration of blockchain technology within traditional systems, leading to hybrid financial landscapes that combine the strengths of both traditional currencies and cryptocurrencies.

- Take a moment to read this blog post that will guide you on how to get started with cryptocurrency investment in Nigeria.

Conclusion on the 10 Biggest Bitcoin Myths

Now that we have debunked the ten biggest Bitcoin myths, it's clear that this digital currency holds immense potential and offers exciting opportunities. By understanding the truth behind these misconceptions, you are better equipped to navigate the world of Bitcoin and cryptocurrency.

If you're eager to get started with Bitcoin and embark on your cryptocurrency journey, look no further than Busha, our trusted cryptocurrency exchange platform. With Busha, you can easily buy, sell, and manage your cryptocurrency portfolio. Whether you're a beginner or an experienced user, Busha provides a simple and secure platform for all types of users.

Don't let these myths deter you from exploring the world of Bitcoin. Take the first step and start your cryptocurrency journey with Busha. Embrace Bitcoin's possibilities and join the ever-growing community of digital currency enthusiasts. Download Busha to get started today and unlock the potential of this groundbreaking technology. Happy trading with Busha!

Read Next: